The SGX Nifty, which traders and investors have used to predict the opening of the Nifty, the indicator for Indian stock markets, for years before the opening up of the domestic markets, has been renamed, the Gift Nifty.

US dollar-dominated contracts of Nifty futures, which is the index of NSE, will now trade on the NSE IX, located in the Gift City SEZ, instead of the Singapore Exchange. The transition comes after regulatory approvals were obtained from the Monetary Authority of Singapore (MAS) and the International Financial Services Center Authority (IFSCA).

Gift Nifty will be accessible for almost 21 hours, and it overlaps with Asia, Europe, and US trading hours. It is open in two sessions - from 6.30 am to 3.40 pm and then again from 4.35 pm to 2.45 am in the second session. This shall be a boon to the day traders globally, facilitating intraday as well as positional trading in Gift Nifty which would mimic the Nifty, barometer of Indian stock markets.

It may be noted that NSE IX is a subsidiary of the NSE, based in Gift City. The stock exchanges operating in the Gift City are allowed to offer trading in securities in international currencies. So, the futures and other derivative contracts are USD-denominated. The NSE IX offers US dollar-denominated trading in various products.

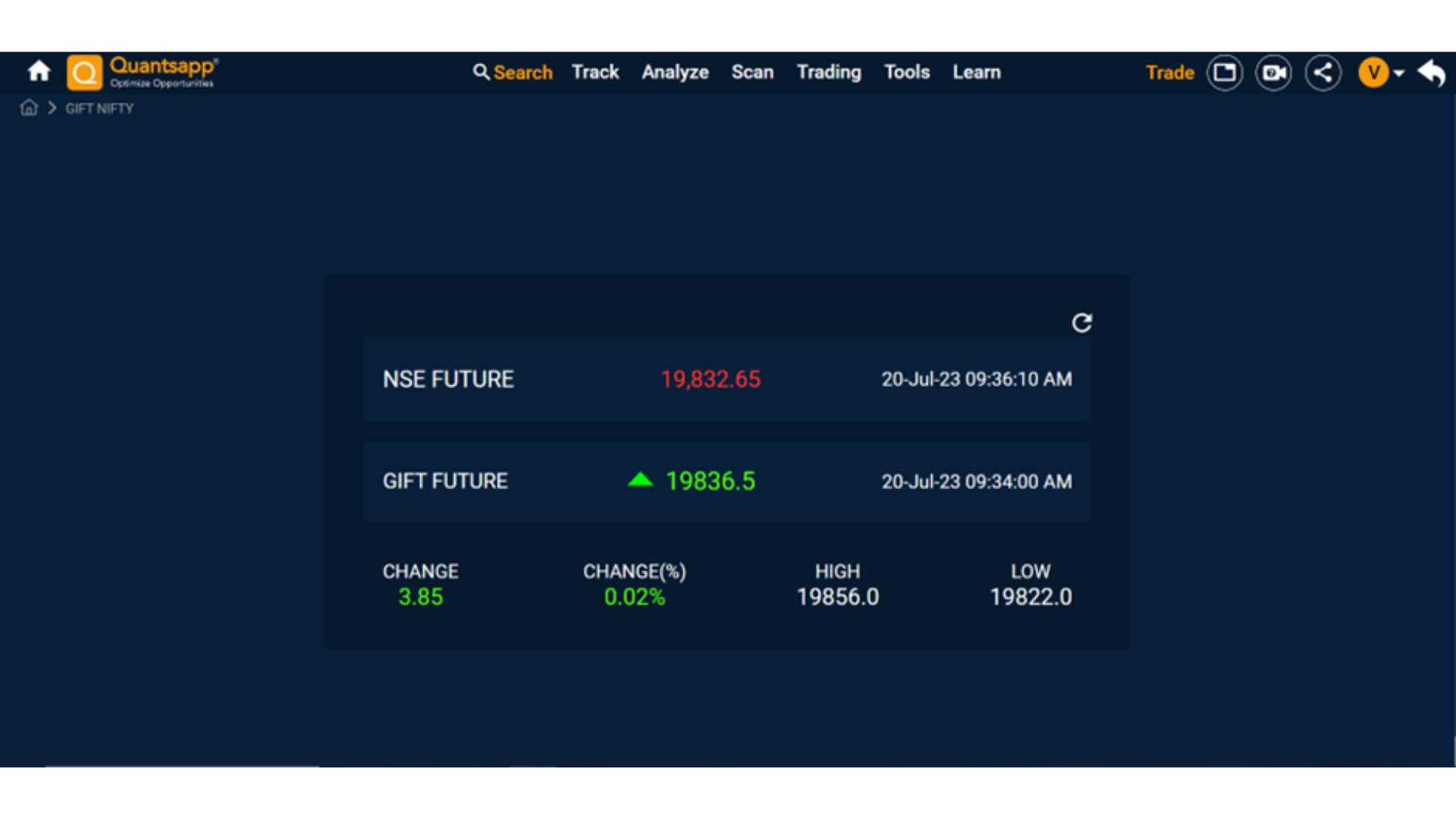

Quantsapp helps them with providing that necessary cue of Gift Nifty Futures Live, as to where the Indian markets, especially Nifty 50 is likely to open. The global presence of investors, day traders pertaining to India, makes the availability of Gift Nifty very important. Getting an indicative price most importantly and trading in Nifty is very useful especially in hours when NSE is not open.

.svg)